Understanding the difference between ABA and routing numbers can be confusing, especially for those who are unfamiliar with banking terminology. In this article, we will explore whether ABA is the same as a routing number and provide detailed insights into both terms. By the end of this guide, you will have a clear understanding of these banking concepts.

When dealing with financial transactions, it is crucial to know the details of your bank accounts, including ABA and routing numbers. These numbers play a vital role in ensuring that money moves accurately and securely between accounts.

This article delves into the intricacies of ABA and routing numbers, their purposes, and their differences. By the end, you will be well-equipped to handle any banking-related questions about these numbers.

Read also:Legacy Marina Fort Myers Fl

Table of Contents

- ABA Overview

- What is a Routing Number?

- Is ABA the Same as Routing Number?

- How to Find Your Routing Number

- ABA in the Banking System

- Common Uses of Routing Numbers

- History of ABA Numbers

- Key Differences Between ABA and Routing Numbers

- Benefits of Understanding ABA and Routing Numbers

- Conclusion

ABA Overview

The American Bankers Association (ABA) developed the routing number system in 1910 to facilitate efficient financial transactions. An ABA number, often referred to as a routing transit number (RTN), is a nine-digit code that identifies a specific financial institution in the United States.

What Does ABA Stand For?

ABA stands for American Bankers Association. It is the organization responsible for creating the routing number system. This system ensures that banks can process checks, electronic payments, and wire transfers accurately.

How Does ABA Work?

ABA numbers work by providing a standardized method for identifying banks and financial institutions. When you initiate a transaction, the ABA number helps direct the funds to the correct institution. This system is essential for maintaining the integrity of financial transactions.

What is a Routing Number?

A routing number is a nine-digit code used in the United States to identify financial institutions. It is crucial for processing checks, wire transfers, and automated clearing house (ACH) transactions. Each bank or credit union has its unique routing number.

How to Identify Your Routing Number

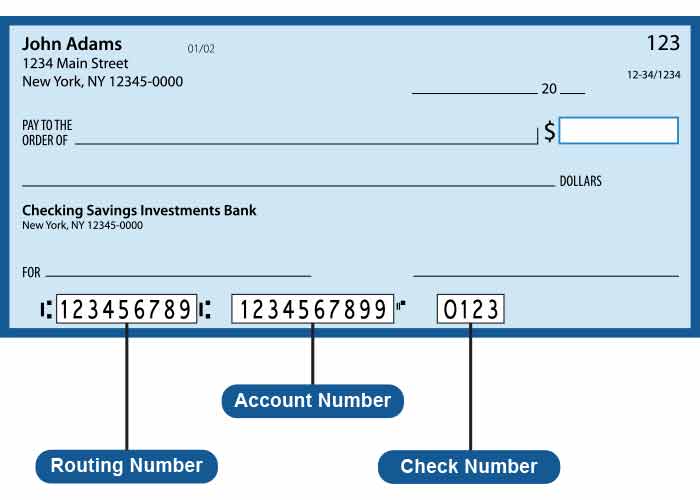

Your routing number can typically be found at the bottom of your checks. It is the first set of numbers on the left-hand side. Additionally, most banks provide this information on their websites or through customer service.

Is ABA the Same as Routing Number?

The terms ABA and routing number are often used interchangeably, and for good reason. They refer to the same nine-digit code used to identify financial institutions in the United States. However, the term "ABA" specifically refers to the American Bankers Association, which created the system, while "routing number" is a more general term.

Read also:Lake End Park Campground

Key Points to Remember

- ABA and routing numbers refer to the same code.

- Both terms are used in banking to identify financial institutions.

- The ABA created the routing number system.

How to Find Your Routing Number

Finding your routing number is a straightforward process. Here are some methods you can use:

Check Your Checks

Look at the bottom of your checks. The first set of numbers on the left-hand side is your routing number. This is the most common and reliable way to find it.

Visit Your Bank’s Website

Most banks provide routing numbers on their official websites. Simply navigate to the customer support or account information section to locate it.

Contact Customer Service

If you are unsure about your routing number, contact your bank's customer service. They can provide you with accurate information tailored to your account.

ABA in the Banking System

The ABA plays a critical role in the banking system by maintaining standards and regulations for financial institutions. The routing number system is just one example of its contributions to the industry.

Functions of the ABA in Banking

- Developing and maintaining industry standards.

- Providing resources and training for financial professionals.

- Advocating for the banking industry on legislative and regulatory matters.

Common Uses of Routing Numbers

Routing numbers are essential for various types of financial transactions. Here are some of the most common uses:

Wire Transfers

When you send or receive money through a wire transfer, the routing number ensures that the funds are directed to the correct bank.

Direct Deposits

Employers use routing numbers to deposit employees' salaries directly into their bank accounts. This method is fast, secure, and convenient.

Bill Payments

Routing numbers are also used for automatic bill payments. Many utility companies and service providers allow customers to set up recurring payments using their bank account information.

History of ABA Numbers

The history of ABA numbers dates back to 1910 when the American Bankers Association introduced the routing number system. At the time, the primary goal was to streamline the processing of checks. Over the years, the system has evolved to accommodate new technologies and transaction methods, such as electronic payments and wire transfers.

Evolution of ABA Numbers

As technology advanced, the ABA number system adapted to meet the changing needs of the banking industry. Today, routing numbers are an integral part of modern financial infrastructure, supporting a wide range of transactions.

Key Differences Between ABA and Routing Numbers

While ABA and routing numbers refer to the same concept, there are subtle differences in how the terms are used:

Terminology

ABA specifically refers to the American Bankers Association, which created the system, while routing number is a more general term used to describe the nine-digit code.

Context

In some contexts, ABA may be used to emphasize the historical origins of the system, while routing number is used in everyday banking terminology.

Benefits of Understanding ABA and Routing Numbers

Having a clear understanding of ABA and routing numbers can benefit you in several ways:

Improved Financial Literacy

Knowing how these numbers work can enhance your overall financial literacy, making you more confident in managing your accounts.

Preventing Errors

Understanding routing numbers can help you avoid costly mistakes, such as entering the wrong number during a transaction.

Enhanced Security

By being aware of how routing numbers function, you can better protect your financial information from fraud and unauthorized access.

Conclusion

In conclusion, ABA and routing numbers are essentially the same thing, with ABA referring to the organization that created the system and routing number being the more commonly used term. Understanding these numbers is essential for anyone who deals with financial transactions, whether it's through checks, wire transfers, or direct deposits.

We encourage you to share this article with others who may benefit from learning about ABA and routing numbers. If you have any questions or comments, please feel free to leave them below. Additionally, explore our other articles for more insights into personal finance and banking.

Data Sources:

- American Bankers Association (ABA)

- Federal Reserve Board

- National Check Fraud Center